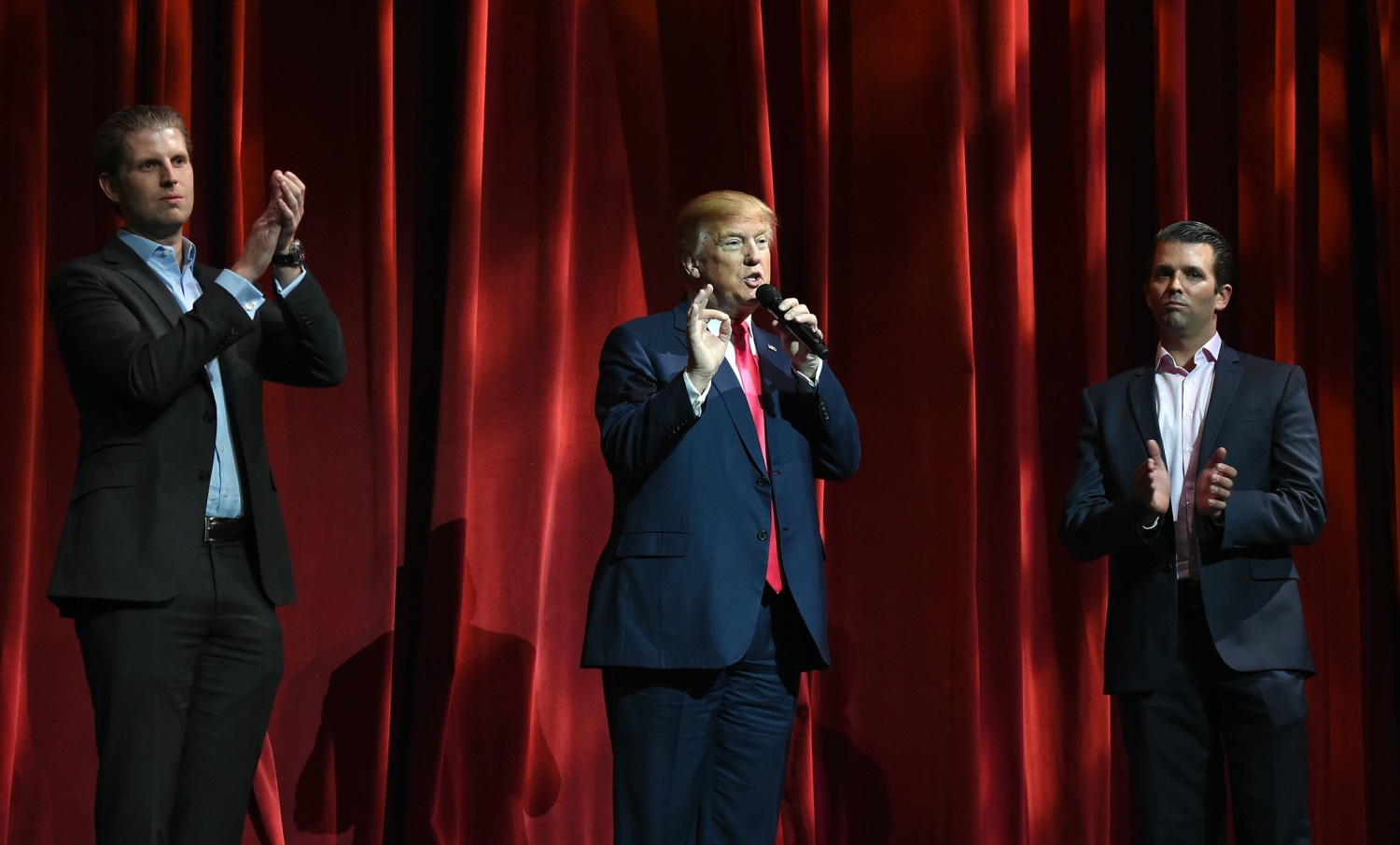

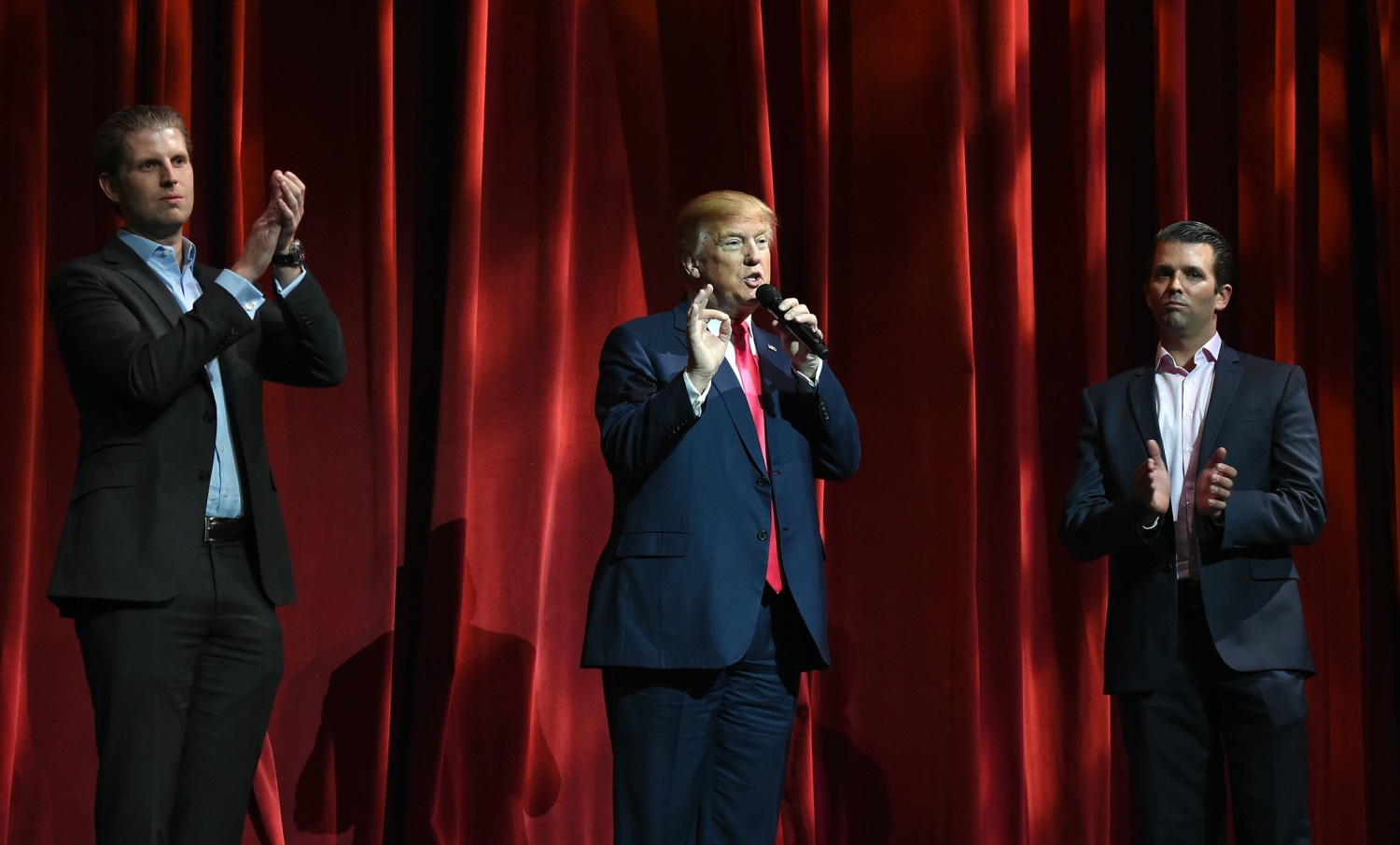

Trump family gets 75% of crypto coin revenue, has no liability, new document reveals

Donald Trump’s crypto project, World Liberty Financial, published a 13-page document Thursday that

described its mission and how tokens can be allocated, and that indicated that the Republican

presidential nominee and his family could take home 75% of net revenue. In what it calls the “World

Liberty Gold Paper,” World Liberty Financial, or WLF, said the Trump family will receive 22.5 billion

”$WLFI” tokens, currently valued at $337.5 million, based on the price of 1.5 cents per token at launch

this week. Trump, who’s in a virtual dead heat with Vice President Kamala Harris as the election reaches

its closing stages, has spent months pumping his crypto project, previously branding it as “The DeFiant

Ones,” a play on DeFi, short for decentralized finance. On Tuesday, the project launched the WLFI token

and said in a roadmap that it was looking to raise $300 million at a $1.5 billion valuation in its

initial sale. As of Thursday, only $12.9 million worth of the token has been sold, according to its

website. The paper released Thursday shows that Trump and his family assume no liability. It indicates

that none of them are directors, employees, managers or operators of WLF or its affiliates, and said the

project and the tokens “are not political and have no affiliation with any political campaign.” WLF

didn’t respond to a request for comment. The Trump campaign referred questions to the Trump

Organization, which didn’t immediately responded to a request for comment. Crypto projects typically

release white papers before they launch their coins, offering a guide so that investors can learn more

about the mission, goals and how future tokens get allocated. WLF’s paper says that a Delaware-based

company named DT Marks DEFI LLC, which is connected to the former president, is set to receive

three-quarters of the net protocol revenues. WLF bills itself as a crypto bank where customers will be

encouraged to borrow, lend and invest in digital coins. The document released Thursday defines net

protocol revenue as income to WLF from “any source, including without limitation platform use fees,

token sale proceeds, advertising or other sources of revenue, after deduction of agreed expenses and

reserves for WLF’s continued operations.” Some $30 million of the initial revenue is earmarked to be

held in a reserve intended to cover operating expenses and other financial obligations. The remaining

25% of net protocol revenue is set to go to Axiom Management Group, or AMG, a Puerto Rico LLC wholly

owned by Chase Herro and Zachary Folkman, two of the co-founders. Folkman previously had a company

called Date Hotter Girls and reportedly helped develop crypto project Dough Finance. Herro worked on

Dough and launched another crypto trading business a decade ago called Pacer Capital, which appears to

now be defunct. AMG has agreed to allocate half of its rights to net protocol revenues to a third LLC

called WC Digital Fi, which is an affiliate of Trump’s close friend and political donor, Steve Witkoff,

as well as to “certain of his family members.” Witkoff’s son, Zachary, is also listed as one of the

co-founders of the project. Folkman previously said just 20% of WLF’s tokens would be allotted to the

founding team, which includes the Trump family. The paper spells out the breakdown of anticipated coin

allocation, with 35% of total supply allocated to the token sale, 32.5% to community growth and

incentives, 30% to initial support allocation, and 2.5% to team and advisors. The document specifies in

the fine print that these “anticipated token distribution amounts are subject to change.” It’s unclear

which categories include Trump and his family. The paper calls Trump the “chief crypto advocate.” His

three sons are all “Web3 ambassadors.”