Leak Reveals BlackRock Is Quietly Doubling Down On Bitcoin As The Price Suddenly

Rockets Toward $100,000

Share to Facebook

Share to Twitter

Share to Linkedin

Bitcoin and crypto prices have surged this week as traders cheer Donald Trump's decisive U.S. election

victory, putting a $100,000 bitcoin price in view.

Unlock over $3,000 in perks including unparalleled access to a community of top Web3 entrepreneurs,

creators, and investors, providing you with premium networking, priority access to global events, Free

access to Forbes.com and our Forbes CryptoAsset & Blockchain Advisor newsletter. Apply now!

The bitcoin price has climbed through 2024 on the back of Trump's embrace of bitcoin as well as

expectations of Federal Reserve interest rate cuts and China stimulus measures and Wall Street adoption.

Now, as markets brace for a Trump "game-changer," a leak has revealed the world's largest asset manager

BlackRock is in discussions to buy a stake in the "king" of spot bitcoin exchange-traded fund (ETF)

holders.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the

crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

Forbes‘$100,000 By 2025’—Donald Trump And Elon Musk Fuel Huge Bitcoin Price Predictions As Dogecoin

SoarsBy Billy Bambrough

MORE FOR YOU

Today’s NYT Mini Crossword Answers For Friday, November 8

Federal Judge Strikes Down Biden Program Offering Legal Status To Undocumented Spouses Of U.S. Citizens

Can Trump Fire Jerome Powell? Fed Chairman Says He Won’t Resign If Trump Asks

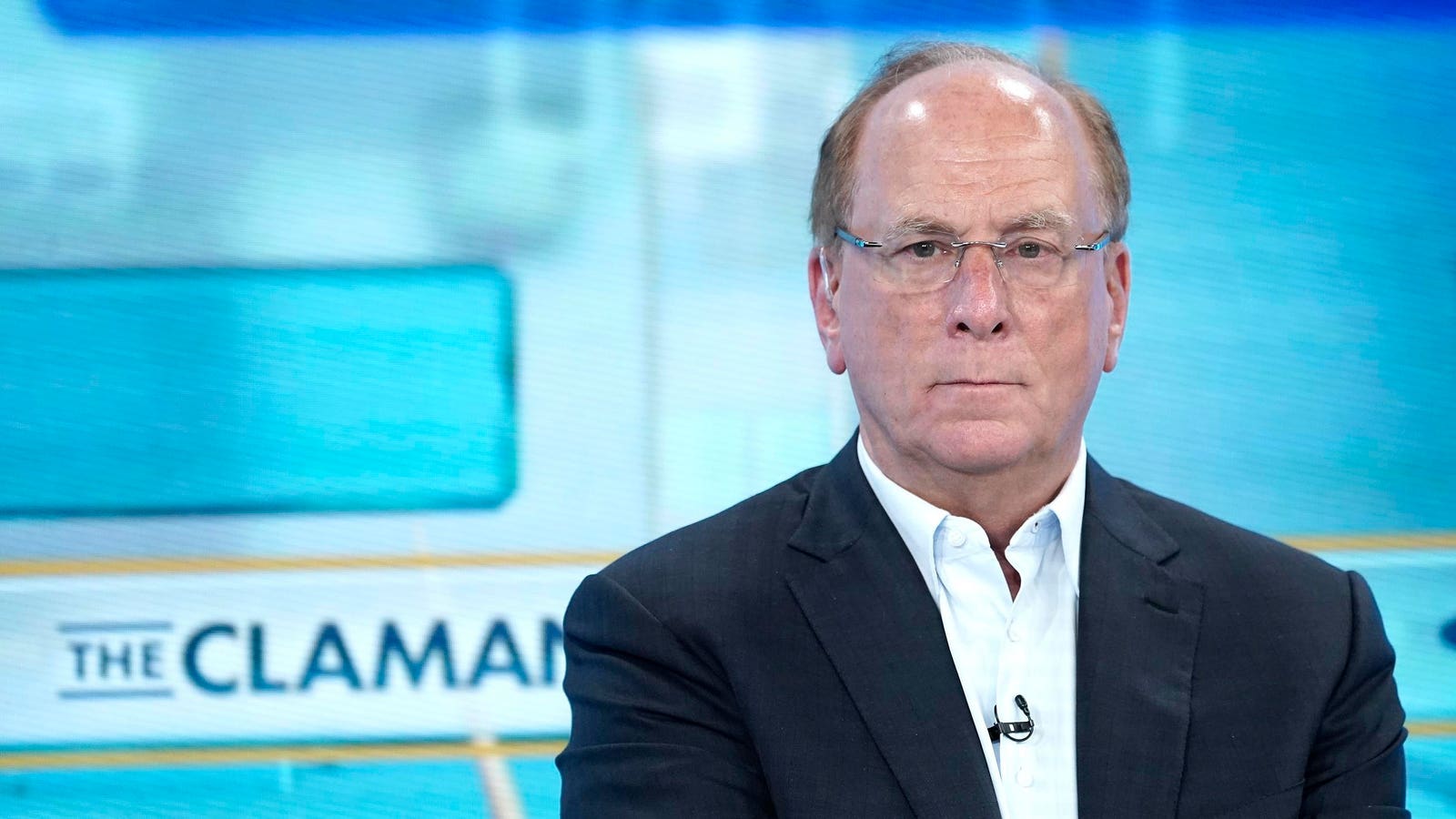

BlackRock chief executive Larry Fink has steered the world's largest asset manager toward bitcoin ...

[+] and crypto in recent years, catapulting the bitcoin price higher.

Getty Images

BlackRock, the world's largest asset manager that's in the middle of a multi-stage plan to digitize Wall

Street with crypto and blockchain, is in discussions to buy a small equity stake in $70 billion

alternative asset manager Millennium, a hedge fund described as the "king" of bitcoin ETF holders,

according to a Financial Times report citing anonymous sources.

Earlier this year, Millennium was revealed to hold nearly $2 billion in spot bitcoin ETFs as of the

first quarter of 2024, with almost $2 billion across five spot bitcoin ETFs, led by a near-$800 million

stake in BlackRock's IBIT bitcoin fund.

Last month, BlackRock chief executive Larry Fink outlined his plan for bitcoin, ethereum and crypto

during BlackRock's third quarter earnings call, predicting bitcoin, ethereum and crypto will "overlay"

with artificial intelligence.

"We believe bitcoin is asset class in itself, it is an alternative to other commodities like gold,"

Fink, who last year led the charge on Wall Street to bring a fully-fledged spot bitcoin ETF to U.S.

markets.

The arrival of a fleet of spot bitcoin ETFs on Wall Street this year was the first step in what Fink

branded a digital "revolution" when he revealed his crypto ambitions for BlackRock—which includes a

blockchain-based alternative to the U.S. dollar.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

ForbesA Trump U.S. Strategic Bitcoin Reserve ‘Game-Changer’ Is Suddenly Hurtling Toward The Bitcoin

PriceBy Billy Bambrough

The bitcoin price has surged this year, in large part due to BlackRock's huge spot bitcoin ... [+]

exchange-traded fund (ETF).

Forbes Digital Assets

On Thursday, BlackRock's IBIT saw a record net inflows, with $1.1 billion flowing into its bitcoin fund

and blowing its previous record, set in late October, of almost $900 million out of the water.

"We expect continued inflows into both exchanges and ETFs, leading to increased market volatility and

potential spillover effects into other crypto investment funds," Caroline Bowler, chief executive of BTC

Markets, said in emailed comments, pointing to BTC Markets' 300% increase in user logins this week.

"This could drive broader liquidity and trading volume. There is also a significant risk of a feedback

loop, where rising ETF inflows push bitcoin prices higher, attracting more capital. Overall, this surge

in interest suggests that bitcoin is increasingly viewed as a core investment asset rather than a

speculative play, potentially marking the beginning of a sustained period of heightened activity in the

crypto market."

Follow me on Twitter.

Billy Bambrough

Editorial Standards

Forbes Accolades